Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

07/17/2023

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored.

In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

US Oil & Gas Midstream Market Analysis

During the projected timeframe of 2022-2027, the US oil and gas midstream market is anticipated to demonstrate a Compound Annual Growth Rate (CAGR) exceeding 4.15%. This growth can be attributed to factors such as escalating investments in the pipeline sector, amplified production and consumption of oil and gas, and the emergence of upcoming LNG terminal projects that are poised to stimulate market demand. Nonetheless, the market's progress may be impeded by the significant volatility of crude oil prices and a decline in consumption, which are expected to pose challenges to the US oil and gas midstream market throughout the forecast period.

- The transportation segment is expected to dominate the United States oil and gas midstream market, owing to the upcoming pipeline projects.

- Increasing investments and development of complex offshore fields are expected to increase the demand for midstream services. Therefore, this factor is expected to provide a great opportunity for the US oil and gas midstream sector during the forecast period.

- An increasing gas pipeline network is expected to drive the growth of the US oil and gas midstream market significantly during the forecast period.

Stars align for midstream M&A in 2022

With dealmaking slowing down during the pandemic, companies seeking to streamline their portfolios and private equity investors looking for exit opportunities found the valuations in 2022 to be more attractive. On the other hand, asset buyers, benefiting from improved balance sheets and excess cash flow, felt more confident in pursuing acquisitions. These deals offered a way to enhance their asset base without the complexities associated with new construction, which are further compounded by challenges like high inflation, supply chain disruptions, and labor constraints.

This combination of factors created opportunities for sellers to monetize their assets and for buyers to expand their footprints or increase their stake in specific assets. Among the notable deals in 2022 were Targa Resources' acquisition of Lucid Energy Group for $3.6 billion, Enterprise Products Partners' acquisition of Navitas Midstream for $3.25 billion, and KKR/Pembina Pipeline Corporation's $1.3 billion USD acquisition of Energy Transfer Canada. In addition to these larger transactions, smaller deals allowed companies to bolster their core businesses. It's worth mentioning that the consolidation of master limited partnerships (MLPs) by their parent companies continued in 2022, and some energy infrastructure firms made noteworthy acquisitions in the renewable energy sector as well.

Several companies increased their stakes in assets

- DT Midstream

DTM seized an attractive opportunity by doubling its stake in the Millennium Pipeline, a crucial interstate natural gas pipeline and compression network. They now hold an impressive 52.5% stake, valued at a staggering $552 million.

- Keyera Corp

KEY CN demonstrated their strategic vision by acquiring an additional 21% stake in the Keyera Fort Saskatchewan complex joint venture. This exceptional NGL processing and storage complex in Alberta is now more firmly under their control, following a $270 million investment from Plains All American (PAA).

- Enbridge

ENB CN and PAA united forces to secure an exceptional deal, acquiring Western Midstream's (WES) coveted 15% stake in the Cactus II Pipeline. This oil pipeline, connecting the thriving Delaware basin to Corpus Christi, Texas, was acquired for a remarkable $265 million.

- Targa Resources

TRGP made headlines with their recent announcement to acquire the remaining 25% interest in the Grand Prix Pipeline. This pipeline seamlessly connects TRGP's gathering and processing (G&P) positions in the Permian basin, Texas, and Oklahoma to their state-of-the-art fractionation and storage complex at Mont Belvieu. The deal, valued at a staggering $1.05 billion, solidifies Targa Resources' dominance in the industry.

Select companies were particularly active on the M&A front

Several companies engaged in multiple transactions throughout the year, apart from the discussed PAA and ENB deals.

|

Company |

Deal |

Value |

|

Williams Companies (WMB) |

Acquisition of Trace Midstream's G&P assets in the Haynesville |

$950 million |

|

Williams Companies (WMB) |

Acquisition of NorTex Midstream |

$423 million |

|

Williams Companies (WMB) |

Acquisition of MountainWest Pipelines |

$1.5 billion |

|

Crestwood Equity Partners (CEQP) |

Acquisition of Sendero Midstream Partners in the Delaware Basin |

$600 million |

|

Crestwood Equity Partners (CEQP) |

Buyout of First Reserve's 50% interest in the Crestwood Permian Basin Holdings joint venture |

$320 million (in units) |

|

Crestwood Equity Partners (CEQP) |

Sale of G&P assets in the Barnett to EnLink Midstream |

$275 million |

|

Crestwood Equity Partners (CEQP) |

Divestiture of G&P assets in the Marcellus to Antero Midstream |

$205 million |

Recapping the Top 5 US Midstream Stories of 2022

The compilation of Top 5 US stories was based on the readership numbers from our website throughout the year, along with valuable input from our staff.

#1. Whistler’s Lateral Pipeline Expansion Began to Flow

Whistler Pipeline expanded in 2022 with a new 36-inch lateral in Martin County, extending its Midland Basin footprint. The lateral will connect to processing sites and be operational in Q4 2022. Whistler is a 450-mile intrastate pipeline, owned by MPLX LP, WhiteWater, Stonepeak, and West Texas Gas, transporting natural gas from the Permian Basin to Agua Dulce, Texas, with access to South Texas and export markets.

#2. ET Eyes Permian Pipeline, Starts Gulf Run Construction

Energy Transfer initiated the construction of the Gulf Run pipeline in Louisiana, aiming to transport gas from the Haynesville Shale across Texas, Arkansas, and Louisiana to the Gulf Coast. The Gulf Run project benefits from a 20-year agreement involving QatarEnergy (70%) and Exxon Mobil Corp (30%), supporting the $10 billion Golden Pass LNG export plant currently under construction in Texas.

Energy Transfer anticipates completing the Gulf Run pipeline by the end of 2022. This project will add approximately 1.25 billion cubic feet per day (Bcf/d) of capacity and necessitate the installation of around 260 miles (418 kilometers) of new pipeline.

#3. Enbridge Expanding Pipeline to Texas LNG Brownsville

Texas LNG Brownsville and Enbridge have signed a pipeline transportation precedent agreement to expand the Valley Crossing Pipeline (VCP). The expansion aims to deliver around 720 MMcm/d of natural gas to Texas LNG's export facility for at least 20 years. Texas LNG is developing a four million tons per annum LNG export terminal in the Port of Brownsville. The VCP, originating from Agua Dulce, will be extended with a 10-mile lateral to reach Texas LNG's facility, along with the addition of compression facilities. The agreement is subject to standard conditions, and Texas LNG expects to reach the final investment decision in 2022, with commercial operations starting in 2026.

#4. Sempra Wins Extension to Build Pipelines in Texas, Louisiana

Sempra Energy received an extension from FERC to construct pipelines connecting to a Texas LNG plant, with a deadline of March 31, 2023. NextDecade Corp. also sought an extension for its Texas LNG project until November 2028. In 2022, Energy Transfer and Mexico Pacific secured significant LNG deals. FERC's extension suggests a potential relaxation of time restrictions for LNG facility pipelines, benefiting Texas and Louisiana operators.

#5. US Court Vacates Federal Permit for Mountain Valley Pipeline

The 4th Circuit of the U.S. Court of Appeals has invalidated federal approvals for Equitrans Midstream's Mountain Valley natural gas pipeline. The court ruled against the U.S. Forest Service and the Bureau of Land Management, stating that their decisions allowing the pipeline to cross through the Jefferson National Forest were flawed. Equitrans is currently reviewing the court's decision and considering the project's next steps and timeline. The loss of the permit is expected to delay the completion of the pipeline beyond the initial target of summer 2022. Initially estimated to cost $3.5 billion and be operational by late 2018, the 303-mile pipeline faced construction setbacks. In August, FERC granted the Mountain Valley Pipeline a four-year extension to complete the project.

Midstream Energy Companies in North and South America, from Strongest to Weakest

North and South American midstream energy companies experienced improved credit quality in 2022 due to strong demand and favorable macroeconomic factors. The sector benefited from concerns about global energy security and robust economic activity, leading to stable ratings outlooks for 80% of the sector. Although negative outlooks increased slightly to 13%, midstream companies were able to generate discretionary cash flow and strengthen their balance sheets by reducing debt and returning capital to shareholders. These positive trends are expected to continue, further enhancing credit quality. While S&P Global ratings consider base-case assumptions, they also account for potential short-term volatility in volumes and commodity prices.

|

Company |

Outlook |

Stand Alone Credit Profile |

Business Risk Profile |

Cash Flow Adequacy & Leverage |

Liquidity |

|

Colonial Enterprises Inc. |

Stable |

a |

Excellent |

Intermediate |

Strong |

|

Northern Natural Gas Co. |

Stable |

a- |

Strong |

Intermediate |

Adequate |

|

Eastern Energy Gas Holdings LLC |

Stable |

bbb |

Strong |

Significant |

Adequate |

|

Enterprise Products Partners L.P. |

Stable |

a- |

Strong |

Intermediate |

Adequate |

|

Enbridge Inc. |

Stable |

bbb+ |

Excellent |

Significant |

Adequate |

|

Florida Gas Transmission Co. LLC |

Stable |

bbb+ |

Strong |

Intermediate |

Adequate |

|

Magellan Midstream Partners L.P. |

Stable |

bbb+ |

Strong |

Significant |

Adequate |

|

Kinder Morgan Inc. |

Stable |

bbb |

Excellent |

Aggressive |

Adequate |

|

ONEOK Inc. |

Stable |

bbb |

Strong |

Significant |

Strong |

|

Gray Oak Pipeline LLC |

Stable |

bbb |

Strong |

Significant |

Adequate |

|

Energy Transfer L.P. |

Positive |

bbb- |

Strong |

Significant |

Adequate |

|

Texas Gas Transmission LLC * |

Stable |

a- |

Satisfactory |

Minimal |

Adequate |

|

Western Midstream Operating L.P. |

Stable |

bbb- |

Satisfactory |

Significant |

Strong |

|

Inter Pipeline Ltd. |

Negative |

bb+ |

Strong |

Highly Leveraged |

Adequate |

|

Hess Midstream Operations L.P. |

Stable |

bb+ |

Fair |

Intermediate |

Adequate |

|

Crestwood Equity Partners L.P. |

Stable |

bb |

Fair |

Significant |

Strong |

|

Sunoco L.P. |

Stable |

bb |

Fair |

Significant |

Strong |

|

Harvest Midstream I L.P. |

Stable |

bb- |

Weak |

Significant |

Adequate |

|

Paradigm Midstream LLC |

Stable |

b |

Weak |

Aggressive |

Adequate |

|

Genesis Energy L.P. |

Stable |

b |

Fair |

Highly Leveraged |

Adequate |

Country risk has minimal impact on the corporate industry and country risk assessment (CICRA) for the midstream energy sector, as the majority of rated companies operate in jurisdictions with very low country risk. Group ownership is considered a rating factor for approximately 18% of the portfolio, with S&P Global Ratings analysis indicating that it constrains the standalone credit profile (SACP) for around 2% of companies, improves the stand-alone credit profile (SACP) for 10%, and lowers the rating for the remaining affiliated companies.

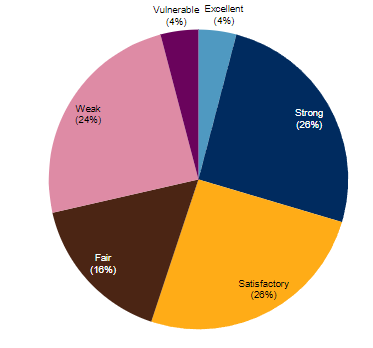

Business Risk Profile Distribution

Roughly 56% of S&P Global Ratings BRP assessments indicate satisfactory or better performance, often indicating substantial size, scale, and a strong competitive position or contractual foundation. On the other hand, lower BRP assessments typically point to weaker competitive positions resulting from a limited geographic presence, considerable commodity or volume risk, or less favorable contracts that support cash flow.

Chart: Midstream Energy Companies Business Risk Profile Distribution

Source: S&P Global Ratings

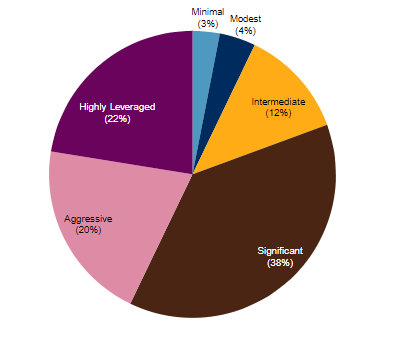

Cash Flow And Leverage Distribution

In the midstream energy sector, financial risk profile assessments lean towards higher-risk categories and tend to weaken as ratings transition from investment-grade to speculative-grade, as one would anticipate. Approximately 80% of the rated universe consists of highly leveraged, aggressive, and significant FRPs, while the stronger intermediate financial risk category represents the majority of the remaining assessments. The highly leveraged assessment applies to 22% of rated issuers and typically indicates companies with strained balance sheets or sponsor-backed holding company loans. Intermediate and stronger assessments primarily apply to companies with significantly lower standalone leverage compared to their owners and have SACPs (Standalone Credit Profiles) that are generally constrained by the group credit profile.

Chart: Midstream Energy Companies Cash Flow And Leverage Distribution

Source:S&P Global Ratings

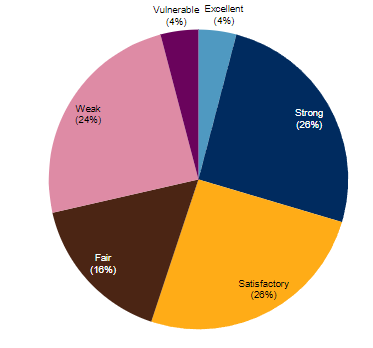

Liquidity Distribution

S&P Global evaluates the liquidity of most issuers as adequate or better. This is significant because companies generally have the ability to fund their capital needs internally and do not heavily rely on issuing equity for funding. Typically, the cash flow generated by these companies, along with their liquidity resources, is expected to cover their committed cash outflows over the next 12 months by a factor of 1.2 times or more.

Chart: Midstream Energy Companies Liquidity Distribution

Source: S&P Global Ratings

Key regulatory issues

Within the midstream sector, the Federal Trade Commission employs a defined framework for determining product markets, focusing on specific petroleum products and their transportation, refining, or storage methods. The FTC has taken enforcement measures in situations where customers in a particular region would face limited competitive alternatives for a specific product. For example, in June 2022, the FTC mandated divestitures in response to Buckeye Partners' acquisition of Magellan Midstream Partners, which would have resulted in highly concentrated markets for gasoline terminaling in three cities.

The United States has consistently used sanctions to discourage companies and vessels from helping certain disliked regimes. For instance, they have imposed strong sanctions on midstream assets, like Chinese terminal operators, that have been involved in transporting oil products from Iran and Venezuela. These actions show that the United States is determined to limit support for sanctioned regimes and pursue its policy goals.

Finally, in the oil and gas M&A sector, the availability and use of R&W (Representation and Warranty) insurance vary depending on the specific area of the industry, such as upstream, midstream, downstream, or oilfield services. Environmental risk coverage is becoming more common overall. In the midstream sector, the use of R&W insurance has been increasing steadily. However, providers often conduct thorough investigations into asset condition, title, and important contracts during the due diligence process to assess the underwriting risk. For transactions involving downstream refineries, R&W insurance policies are handled similarly to those for midstream assets, with a particular emphasis on environmental liabilities. In oilfield services transactions, R&W insurance is standard, but extra scrutiny is given to professional liability risks associated with workplace injuries.

Long-Term Financial Metrics

During the June 2023 assembly, OPEC+ reached a significant consensus regarding the proposed reduction of 1.16 million barrels per day (Mb/d), a voluntary measure initially put forward in April. This reduction will persist until the conclusion of 2024, with the potential for an extension into 2025. Aiming to ensure stability within the oil market, Saudi Arabia asserted its willingness to undertake any necessary action.

In fact, elevated oil prices are imperative for the Saudi economy to attain fiscal stability and finance crucial initiatives such as the ambitious $500 billion Neom city project. Demonstrating their commitment, the Saudis pledged to further curtail production by an additional 1 million barrels per day, commencing in July 2023. Consequently, this would result in the country's oil output reaching its lowest level in several decades. This strategic maneuver aims to establish a solid foundation for the oil markets, or at the very least, alleviate crude oil price declines throughout the remainder of the year.

Although OPEC+ has extended its production cuts, the U.S. Energy Information Administration (EIA) predicts that global liquid fuels production will rise by 1.5 million barrels per day (Mb/d) in 2023 and 1.3 Mb/d in 2024. This increase is mainly driven by non-OPEC producers, including the United States, Norway, Canada, Brazil, and Guyana, who are expected to contribute significantly to the growth.

According to the EIA, dry natural gas production is expected to average around 103 billion cubic feet per day (Bcf/d) in the second half of 2023 and throughout 2024. The EIA also forecasts that U.S. crude oil production will reach a record high, with an estimated 13.11 million barrels per day (Mb/d) in December 2024. This increase in oil production is primarily driven by growth in the Permian Basin. The EIA recently revised its forecasts for average U.S. oil and gas production in 2023 and 2024. Gas production estimates have increased by 2.1% for 2023 (from 100.67 Bcf/d to 102.74 Bcf/d) and by 1.3% for 2024 (from 101.69 Bcf/d to 103.04 Bcf/d). Oil production estimates have increased by 0.9% for 2023 (from 12.44 Mb/d to 12.56 Mb/d) and by 1.1% for 2024 (from 12.63 Mb/d to 12.67 Mb/d).

Hess Midstream anticipates robust growth in physical volumes across gas, oil, and water systems from 2023 to 2025, with an estimated annualized growth rate of around 10%. This growth is supported by updated minimum volume commitments (MVCs). As a result, the company expects to achieve a minimum of 10% year-over-year growth in Adjusted EBITDA for both 2024 and 2025. Gas processing and gathering activities are projected to contribute approximately 75% of total affiliate revenues in 2024 and 2025, excluding passthrough revenues.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Global Oil Supply and Demand Trends Overview: Insights from Rextag

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R-152 - Blog Global Oil Supply and Demand Trends Overview_ Insights from Rextag.png)

Global oil supply and demand saw notable changes in April 2023. Liquids demand declined by 0.7 MMb/d to 99.9 MMb/d, with gains in China and Europe offset by reduced demand in Japan and the Middle East. OPEC 10 production remained stable at 29.5 MMb/d, while Saudi Arabia increased output by 0.3 MMb/d. Non-OPEC production declined slightly, Russian production dropped further, and US shale production remained steady. Combined production in Iran, Venezuela, and Libya remained unchanged. Commercial inventories increased, and OPEC+ implemented production cuts. Economic sentiment remains uncertain amid rising global inflation.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 181_Blog_From Beginnings to a $7.1 Billion Milestone Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag .png)

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/272_Blog_Exxon Closes $60B Pioneer Deal in the Permian Basin.png)

Exxon Mobil recently completed its acquisition of Pioneer Natural Resources, a deal worth about $60 billion. This transaction, which is the biggest in shale oil history, significantly changes the competitive landscape in the Permian Basin, a major oil field. This marks Exxon Mobil's largest deal since its $84.4 billion merger with Mobil Corp. in 1999. With this acquisition, Exxon Mobil's production in the Permian Basin will double to 1.3 million barrels of oil equivalent per day.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Top-Permian-Oil-and-Gas-Producers-Five-Year-Production.jpg)

OXY has been the leader in Permian Basin production for the past five years. Currently, the Houston-based oil and gas company is deepening its presence in the basin with a $12 billion acquisition of CrownRock, adding over 94,000 acres in the Midland Basin and increasing its oil output by about 170,000 barrels per day. Occidental announced an increase in its proved reserves to 4.0 billion barrels of oil equivalent by the end of December 2023, up from 3.8 billion the previous year. Activities in the Permian largely fueled this rise. Occidental added approximately 303 million barrels through infill development projects as well as new discoveries and the further development of existing fields brought in another 153 million barrels.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R269_Blog_TotalEnergies $5.7B Profit U.S. Rig Count Loose and Crude Oil April Update.png)

TotalEnergies kicked off 2024 with a net income of $5.7 billion in the first quarter, marking a modest 3% increase from the same period last year and a 13% rise from the previous quarter. This growth occurred despite experiencing drops in both the volume and price of gas sales over the year and the quarter. Their adjusted net earnings, which exclude one-time or unusual items, were $5.1 billion. This represents a significant 22% decline compared to last year and a slight 2% drop from the last quarter. The company's earnings before tax, depreciation, and amortization reached $11.5 billion, while their cash flow from operations significantly decreased to $2.2 billion, falling by 58% from last year and a steep 87% from the previous quarter. TotalEnergies also recorded $644 million in impairments.